New York, New York, United States, February 3, 2026

In a strategic move set to revolutionize the tech landscape, Elon Musk has announced the merger of SpaceX and xAI, creating a combined valuation of $1.25 trillion. This consolidation integrates key initiatives like Grok, Starlink, and X, with ambitious plans for a $1.5 trillion IPO. The merger aims to enhance both aerospace and AI sectors while promoting economic growth and job creation. As Musk pursues innovative solutions, the combined entity also looks towards developing solar-powered space-based data centers, positioning itself at the forefront of technological advancement.

Elon Musk’s SpaceX and xAI Merge Ahead of Major IPO

Significant consolidation creates a $1.25 trillion tech powerhouse

New York, New York, United States

Entrepreneurial innovation thrives in the tech landscape, and the latest move from billionaire Elon Musk exemplifies the power of strategic consolidation. Musk has announced the merger of his space exploration company, SpaceX, with his artificial intelligence startup, xAI. This new, combined entity is primed for a highly anticipated initial public offering (IPO) later this year, aiming to revolutionize the aerospace and AI sectors while enhancing the economic ripple effect on industries across the nation.

The merger, valued at approximately $1.25 trillion, aims to integrate key initiatives spearheaded by Musk, including the AI chatbot Grok, satellite internet provider Starlink, and the social media platform X (formerly Twitter). This consolidation is expected to bolster both companies significantly as they prepare for SpaceX’s IPO, targeting a valuation of $1.5 trillion and potentially raising over $50 billion. Such capital could empower a host of smaller businesses and innovators who seek to align with Musk’s forward-thinking vision of the future.

The Implications for SpaceX’s IPO

The notable merger is set to significantly impact SpaceX’s IPO plans. With the combined valuation and enhanced capabilities, investors are likely to exhibit increased confidence, creating an environment ripe for robust investment. This strategic maneuver could also draw attention to other innovative companies within the Bexar County economy that emulate Musk’s model of leveraging technological advancements through collaboration and integration.

Innovating with Space-Based Infrastructure

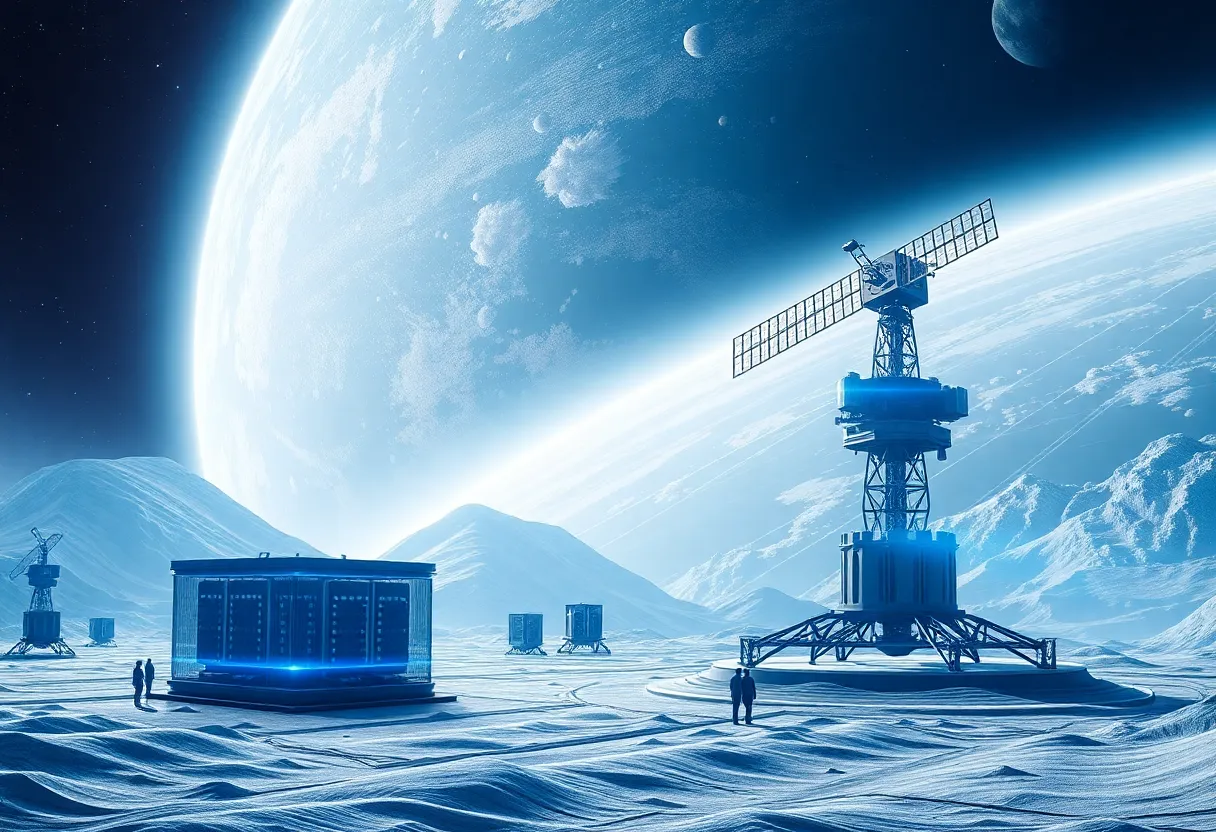

Musk has long advocated for the utility of space as a frontier for technology. The merged entity plans to develop space-based data centers that utilize solar energy to remedy the energy and cooling challenges encountered by terrestrial AI systems. As environmental concerns gain traction, Musk’s ideas present a promising and sustainable alternative that could set new standards for energy usage across the tech sector. The potential for orbital data centers signifies a bold move toward addressing the growing demands of AI in an eco-friendly manner.

Addressing Skepticism from Industry Leaders

While Musk’s plans have garnered enthusiasm, some industry leaders, including representatives from Microsoft, remain skeptical about the feasibility of operating data centers in space. However, Musk envisions a constellation of satellites that would provide AI compute capacity, with ambitious long-term objectives for establishing operations on the Moon and Mars. This’s approach not only aligns with his broader goals of interplanetary colonization but also fosters a new era of economic opportunity that could stimulate job growth for both high-tech and small businesses.

Investment in Earth-Based Data Center

In parallel to the merger, xAI is making a significant investment of $20 billion in a new Earth-based data center, MACROHARDRR, in Mississippi. This commitment to enhancing AI infrastructure on Earth underscores Musk’s unwavering vision to advance technological capabilities on multiple fronts. Such investments reflect a broader economic trend where private enterprises are stepping up to fill gaps in infrastructure, promoting resilience and growth in the tech sector.

Future of the Combined Entity

The success of the merger and the upcoming IPO will heavily rely on sustained investor confidence in Musk’s ambitious vision, which intersects space exploration and AI technology. The unification of Musk’s initiatives into a cohesive innovation ecosystem could reshape the landscape of both aerospace and artificial intelligence industries, ultimately benefiting the economy by highlighting the importance of innovation and private investment.

Key Takeaways

Elon Musk’s merger of SpaceX and xAI marks a significant milestone in the tech industry, with potential implications for economic growth and job creation both locally and nationally. As this combined entity pushes boundaries, it invites other entrepreneurs and businesses to explore innovative solutions, contribute to the economy, and possibly reshape the industries they operate in.

To foster a vibrant economic environment, we encourage our readers to support local innovators and explore opportunities within San Antonio and beyond. Keeping an eye on developments from Musk’s ventures may inspire new paths for local businesses.

Frequently Asked Questions (FAQ)

What companies are merging?

The merger involves Elon Musk’s space exploration company, SpaceX, and his artificial intelligence startup, xAI.

What is the valuation of the combined company?

The combined entity is valued at approximately $1.25 trillion.

What are the key initiatives integrated into the new company?

The new company integrates several Musk-led initiatives, including the AI chatbot Grok, satellite internet provider Starlink, and the social media platform X (formerly Twitter).

What is the significance of the merger for SpaceX’s IPO?

The merger is expected to significantly impact SpaceX’s planned IPO, which is targeting a valuation of $1.5 trillion, potentially raising over $50 billion.

What is Musk’s vision for space-based data centers?

Musk envisions the development of orbital, solar-powered data centers to address energy and cooling challenges associated with terrestrial AI systems.

What are the long-term plans for the combined entity?

The combined entity aims to deploy a constellation of satellites to provide AI compute capacity, with long-term plans for operations on the Moon and Mars, supporting the vision of a multiplanetary civilization.

What is the investment in the new Earth-based data center?

xAI is investing $20 billion in a new Earth-based data center, MACROHARDRR, in Mississippi, to expand its AI infrastructure.

What is the broader goal of this merger and investment?

The broader goal is to unify Musk’s technology ventures under a comprehensive innovation ecosystem, potentially reshaping the landscape of both aerospace and artificial intelligence industries.

Key Features of the Merger and IPO

| Feature | Description |

|---|---|

| Companies Involved | SpaceX and xAI |

| Valuation of Combined Entity | Approximately $1.25 trillion |

| Key Initiatives Integrated | AI chatbot Grok, satellite internet provider Starlink, social media platform X (formerly Twitter) |

| Impact on SpaceX’s IPO | Expected to target a valuation of $1.5 trillion, potentially raising over $50 billion |

| Vision for Space-Based Data Centers | Development of orbital, solar-powered data centers to address energy and cooling challenges of terrestrial AI systems |

| Long-Term Plans | Deployment of satellite constellation for AI compute capacity, with operations on the Moon and Mars |

| Investment in Earth-Based Data Center | $20 billion in MACROHARDRR data center in Mississippi |

| Broader Goal | Unification of Musk’s technology ventures under a comprehensive innovation ecosystem |

Deeper Dive: News & Info About This Topic

HERE Resources

Author: STAFF HERE SAN ANTONIO WRITER

The SAN ANTONIO STAFF WRITER represents the experienced team at HERESanAntonio.com, your go-to source for actionable local news and information in San Antonio, Bexar County, and beyond. Specializing in "news you can use," we cover essential topics like product reviews for personal and business needs, local business directories, politics, real estate trends, neighborhood insights, and state news affecting the area—with deep expertise drawn from years of dedicated reporting and strong community input, including local press releases and business updates. We deliver top reporting on high-value events such as Fiesta San Antonio, San Antonio Stock Show & Rodeo, and Dia de los Muertos. Our coverage extends to key organizations like the Greater San Antonio Chamber of Commerce and United Way of San Antonio and Bexar County, plus leading businesses in retail, insurance, and energy that power the local economy such as H-E-B, USAA, and Valero Energy. As part of the broader HERE network, including HEREAustinTX.com, HERECollegeStation.com, HEREDallas.com, and HEREHouston.com, we provide comprehensive, credible insights into Texas's dynamic landscape.